The Pharma sector has been down for a year now, giving an opportunity to buy some valuable pharma stocks at a reasonable price. I recently started tracking Granules India and I have penned down my points as to what got me attracted to Granules India after going through their annual report.

This is just a research carried out and not a buy/sell report.

Company Snapshot:

- Granules India is a mid-cap pharma company.

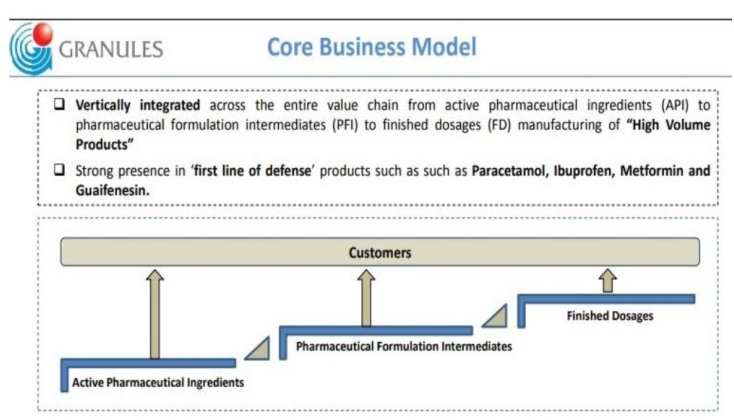

- Present across the entire pharmaceutical manufacturing value chain from active pharmaceutical ingredients (API) to pharmaceutical formulation intermediates (PFI) to finished dosages (FD) manufacturing.

- Manufacturing facilities with approvals from the US, Europe and other regulatory Agencies.

Entered potentially higher-margin products through establishing in-house API and Formulation research centers located at Hyderabad and in Virginia - Acquired Auctus Pharma in 2014 with focus on development of new APIs through in-house R&D for organic ANDA filling and customers’ formulation development

- Presence in potentially higher margin CRAMS business through 50-50 JV with Ajinomoto Omnichem.

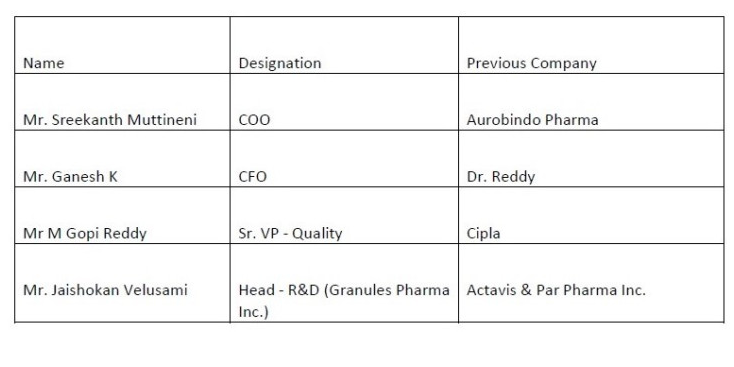

Strong Management Team:

Granules India has been building a very strong management team, below is the list of people hired between FY16-17.

Valuation :

Market Cap.: Rs. 2,905.64 Cr. Current Price: Rs. 112.10

Book Value: Rs. 37.06 Stock P/E: 17.90

Dividend Yield:0.71% Week High/Low: Rs. 157.25 / ₹ 91.45

Promoter holding: 53.44% Debt-to-Equity: 0.73

Points on Valuation :

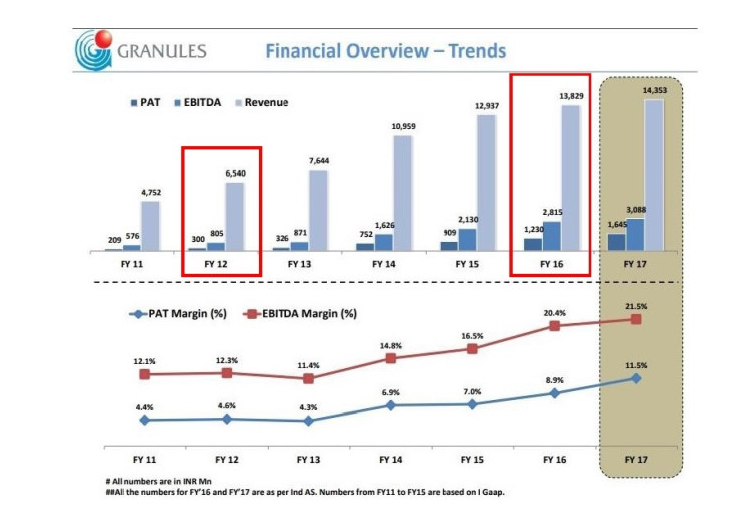

- 5-year CAGR Profit After Tax (Net Profit) FY-12 TO FY 16: 60%(above 20%, Brilliant!)

- 5-year CAGR Revenue FY-12 TO FY 16: 16%(Good, above 15%)

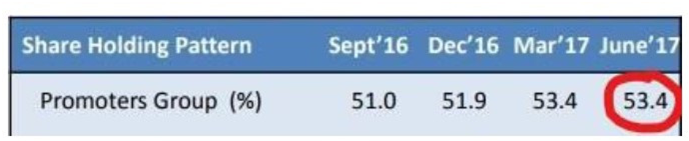

- Promoter Holding is above 50% which is a good sign and the promoters have increased their stake in the recent while to 4%

- Average return on equity 5Years: 21%(above 20%)

- Average return on capital employed 5Years: 60%(above 20%)

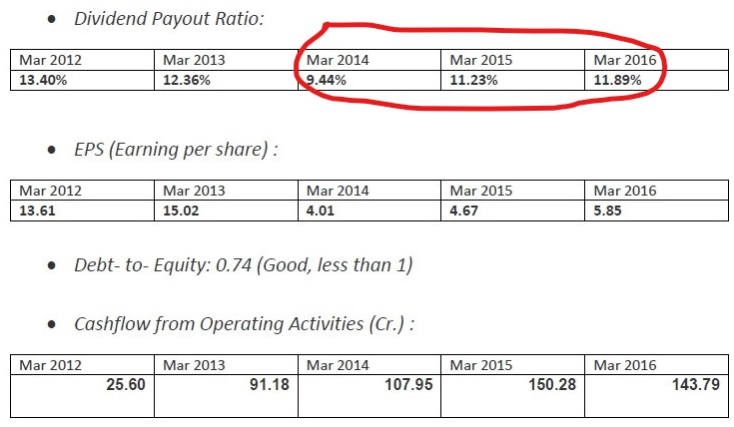

- Cashflow from Operating Activities has increased steadily another good sign that Granules India core business operations are generating cash and can be considered successful.

- EPS has increased from FY 2014 another good sign.

- Good Dividend Payout Ratio.

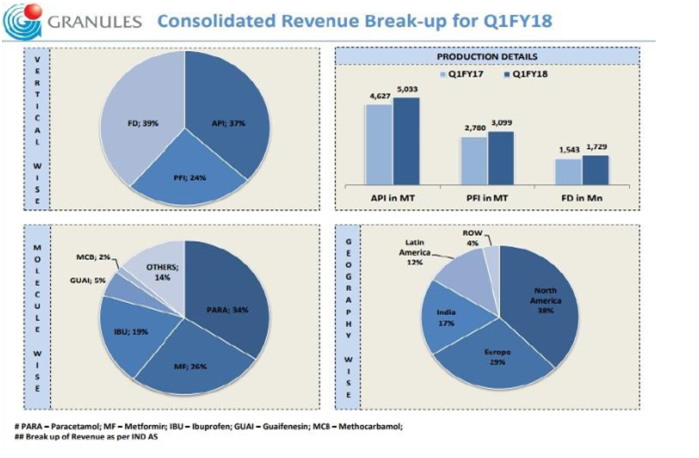

REVENUE BREAKUP:

Even though North America accounts for 38% the rest 62% of the revenue comes from the other region which is the reason why Granules will have lesser impact w.r.t to the ongoing situation.

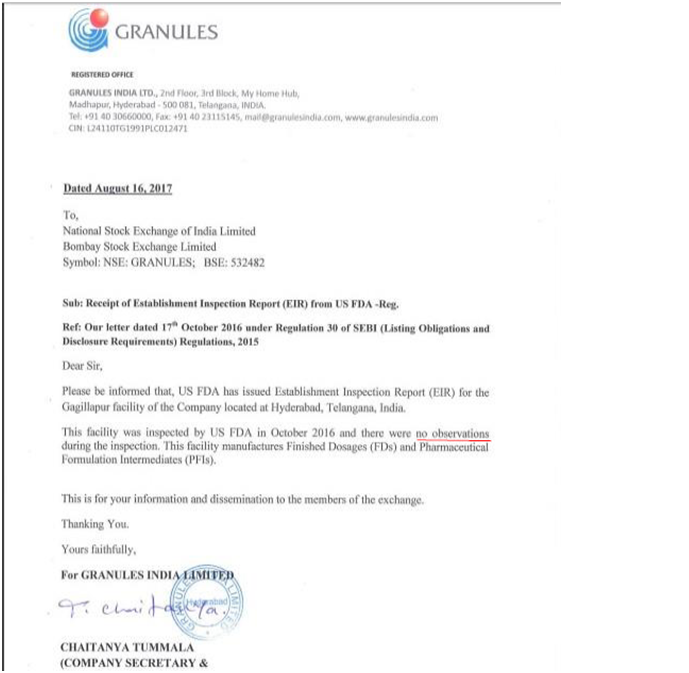

CLEAN CHIT BY USFDA:

One of the most important & dreaded aspects for Pharma companies is the inspections by the US FDA. Fortunately, Granules India has received an all-clear signal

Here is the Receipt of Establishment Inspection Report (EIR) from US FDA.

Granules India surely seems to be on the right path and is worth a look at 🙂

Update 1 : Motilal Oswal bets big on Granules India Target 200 🙂

UPDATE 2 : CMP on 28 Sep : 112 – CMP on 20 Oct : 142 🙂

Disclaimer : This is not a buy/sell report. Report for education and research purposes only. Please do your own due diligence before investing.

looks like a decent call, any target and time frame?

LikeLike