Mahanagar Gas recently caught my attention, and after going through the Annual Report it made me clear that this company has a lot of potential going forward.

Company Snapshot:

Mahanagar Gas Limited (MGL) is one of the largest city gas distribution (CGD) companies in India. With over 22 years of experience in supplying natural gas in Mumbai.

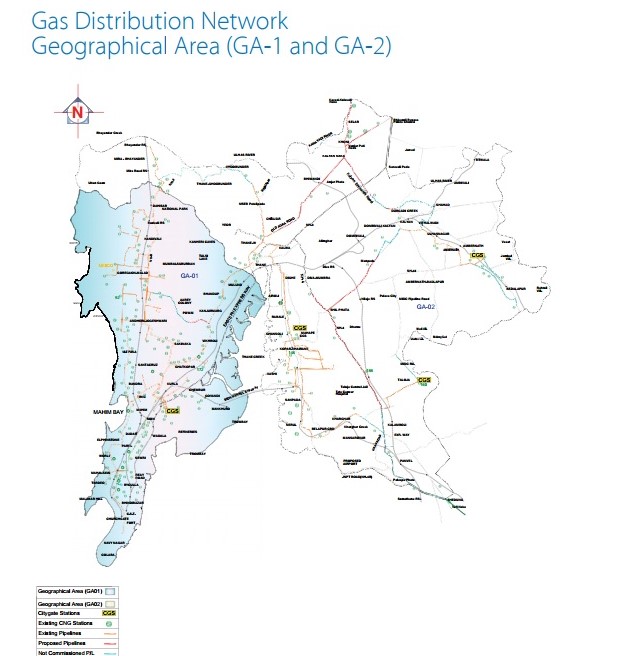

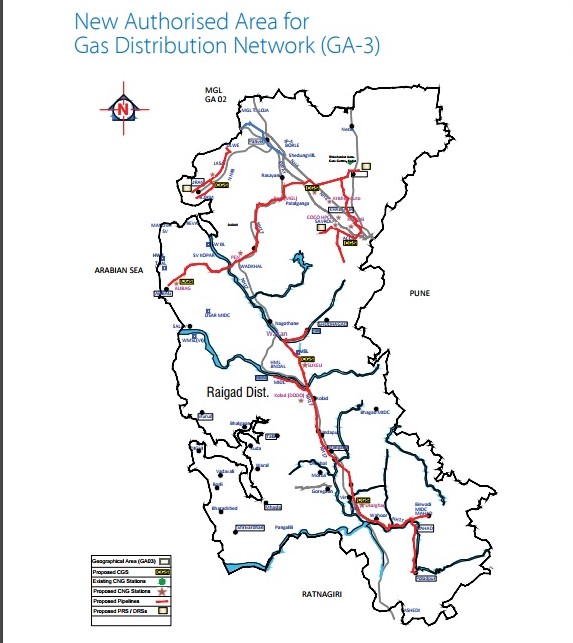

MGL is the SOLE authorised distributor of compressed natural gas (CNG) and piped natural gas (PNG) in Mumbai, Thane urban and adjoining municipalities and the Raigad district in the state of Maharashtra, India.

The Company distributes CNG for use in motor vehicles and PNG for domestic household as well as for commercial and industrial use

What Makes MGL attractive?

- MGL is the sole provider hence has a monopoly in the market. (Need I say anything more? 🙂 )

- Financed its growth from internal cash flows, paid 50% dividend payout yet did not raise debt! It is a debt free company 🙂

- CNG & Piped Natural Gas you cannot live without them! You need PNG every day to turn up the gas stove in your kitchen and you need CNG to refill your cars. So this is not a product where once you sell it you’re done, whereas the use is recurring. (Self-Explanatory)

- CGD Expansion – Smart Cities The NITI AAYOG has envisaged a rollout plan of CGD network development in more than 326 possible circles in a phased manner by 2022.

- As a part of Subsidy give up, PNG is the next best option over gas cylinder as it is economical, much safer & consumes no space like a gas cylinder.

- The Central and State Government have been promoting the use of natural gas by maintaining lower tax rates compared to alternative fuels.

- According to the last year’s Maharashtra Taxi Scheme for Mumbai, the government has stated that cab operators should switch to Unlead Petrol or CNG, within one year.

More Projects (Pipeline network) in hand :

1)MUMBAI & ADJOINING REGIONS – (Red Lines are the proposed pipelines)

2)RAIGAD REGION :

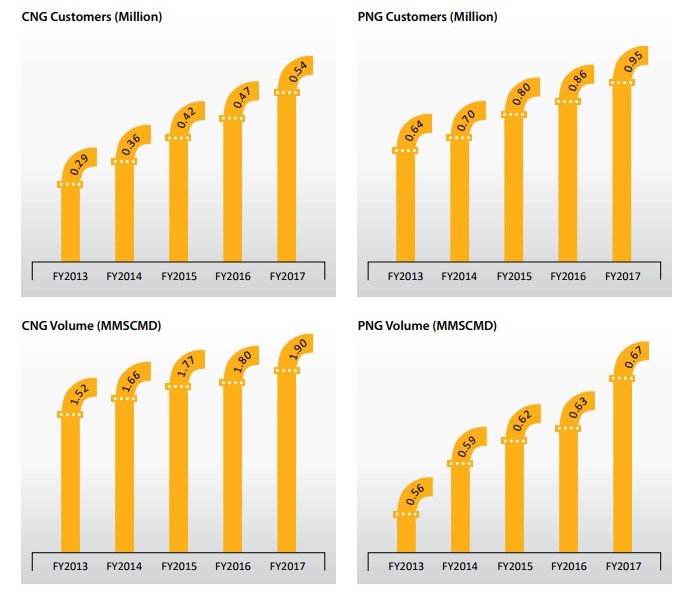

PERFORMANCE HIGHLIGHTS:

Valuation:

Promoter holding: 65.00% (Nice!) Compounded Profit Growth TTM: 30.48% (Great!)

Return on Equity TTM: 22.05% (Above 20%) Debt to equity: 0.0 % (Great! Debt-free)

Stock P/E: 26.25 Dividend Yield: 1.68%

- Sales have increased over 4 years.

- Operating Profit has increased over 4 years.

- Other Income has also increased over 4 years.

- Net Profit has also increased over 4 years. (Not much rise, but its fine)

- Dividend Payout has decreased but is good for 4 years

- Increasing EPS for 3 years 🙂

- Has Total Current Assets > Total Current Liabilities (Good situation)

- Cashflow is positive and increasing, a very good indicator.

With Mahanagar Gas ticking the right boxes it’s a stock a worth looking at. 🙂

Disclaimer: For education and research purposes only. Not a Buy/Sell recommendation.

Are you available on telegram also.

pl send me telegram link on my mail id

bishan2.dixit@gmail.com

LikeLike