So the next stock on the radar is Sakuma Export. So this is not a common or a famous stock with a very high volume though has decent volume, but yes can be tested as the numbers are quite good.

Company Snapshot:

Sakuma Export is a trading company, an export house. The Company is engaged in exports of various commodities like Red Split Lentils, Onions, Peanuts, Peanuts in shell, Brass items, Sugar, Wheat Flour etc. Today it has a Customer Base of over 75 in a number of countries like South East Asia, Middle East, Europe, Africa and the United States of America Markets and sources commodities from close to 400 suppliers directly and indirectly.

Valuation:

Promoter Holding: 69.03% (Nice above 50%)

Current Stock P/E: 9.2

Debt to equity: 0.79 ( Great! < 1)

PEG Ratio : 0.28 (Great! < 1)

Book Value : ₹ 77.40

Average return on equity 5Years: 25.01% (Great!)

Average return on capital employed 5Years: 14.52% (Nice!)

Profit growth 5Years: 40.30 (Too Good! )

Sales growth 5Years: 31.96% (Great!)

Average 5years dividend: 1.64 (Okay)

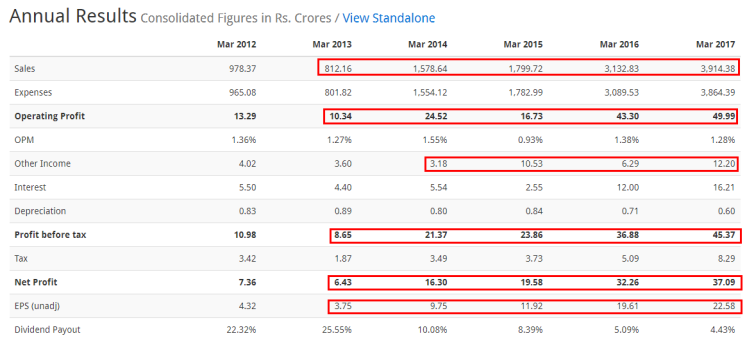

Increasing Sales, EPS, PAT, Operating Profit & Other Income 🙂

Some other Great number! –

- CAGR Sales (’13-’17) = 48%

- CAGR PAT (’13-’17) = 54%

- CAGR EPS (’13-’17) = 56%

The dividend Payout ratio has decreased over the last few years which is a concern but the management says they need funds for expansion as they are in growth mode, so it’s fine if there is a good capital gain.

Analysis :

As our economy is largely backed by agriculture, it gives a good opportunity to trade in commodities. The increasing demand is the fuel to these trading companies. Coupled with the good political setup at the centre the economic growth would surely be intact.

So what affects the business of this company is the global and domestic consumption pattern or in a simple word – DEMAND.

As the company makes money from margins, the margins are not very high as this is very competitive industry but the management is working to increase it, but what matters is the volume. So even if there are small margins the volume should be high.

Sakuma has two international subsidiaries, one in Singapore and other in Dubai which have also posted decent growth.

Currently Sugar, Edible Oil & Pulses are the major verticals.

- The import of Edible Oil estimated for the current year FY17 is around 15.2 MT. For the next year, the estimation is around 16 MT so that’s around 6% growth which is modest.

- With good monsoon this year, it is expected that the sugarcane production for the next year would be high compared to this year with lower prices and coupled with substantial growth in consumption patterns will help Sakuma to boost its business.

So what are the Risks?

Apart from global and domestic economic issues the other risk factors are-

- Foreign Exchange Risk (Sakuma minimizes this by entering into forward contracts)

- Commodity Price Risk

- Monsoon Rains

- A hostile situation or political instability in some countries.

- Any non-favourable policies or reforms in future. (But as of now, the political scenario is good)

So having said that a lot of factors affect the business of the company, the best part of Sakuma was it delivered top of the line growth even after Demonetization and weaker monsoons in Maharashtra & Karnataka, which portrays that Sakuma surely has a good management.

With the growth triggers and appealing numbers, Sakuma is worth a look at! 🙂

Disclaimer: For education and research purposes only. Not a Buy/Sell recommendation.

Sir,

EPS of 8.91(Trailing Twelve Months) and CMP of Rs.209 implies PE of 23.45.(Source ; MoneyControl).

Please clarify am I missing anything.

LikeLike

Look at Consolidated EPS which is 22.5, 8.91 is Standalone.

LikeLike

Dear Ajinkya, thank you for sharing across your findings. Appreciate your efforts and moreover sharing with others. I’ve been trying to figure out such info on various websites/analysts but found only partial info. Your screening certainly helps person like me to understand better and to evaluate..

Once again, thank you.

LikeLike

Its has given a 100% return in 3 months

LikeLike

June 2017 standalone sales havebeen on a decline QoQ . How are teh other subsidaries performed in the last quarter. Looking at consolidated annual number for Mar17 , we will be discounting the under performance in June 2017 . Can you share the subsidaries performance for june and sep 17(if results published)

LikeLike